What Job Seekers and Hiring Managers Actually Use Today

Salary transparency is no longer a “nice to have.” In 2026, it is one of the few areas where candidates still hold real leverage.

The problem is not access to data. It is knowing which data is reliable, current, and grounded in how companies actually pay people today. Too many salary tools still rely on self-reported numbers from years ago, or broad averages that mean very little once you factor in location, seniority, equity, and hiring cycles. And even with the right data, the outcome still depends on salary negotiation. Salary benchmarks set the frame, but how you position your experience, justify your value, and handle the conversation is what determines whether you land at the bottom of the range or the top of it.

Below are the salary benchmarking tools that professionals are actually using in 2026. Five are widely trusted. Two are less talked about, but surprisingly strong if you know how to read them.

The Salary Benchmarking Tools That Matter in 2026

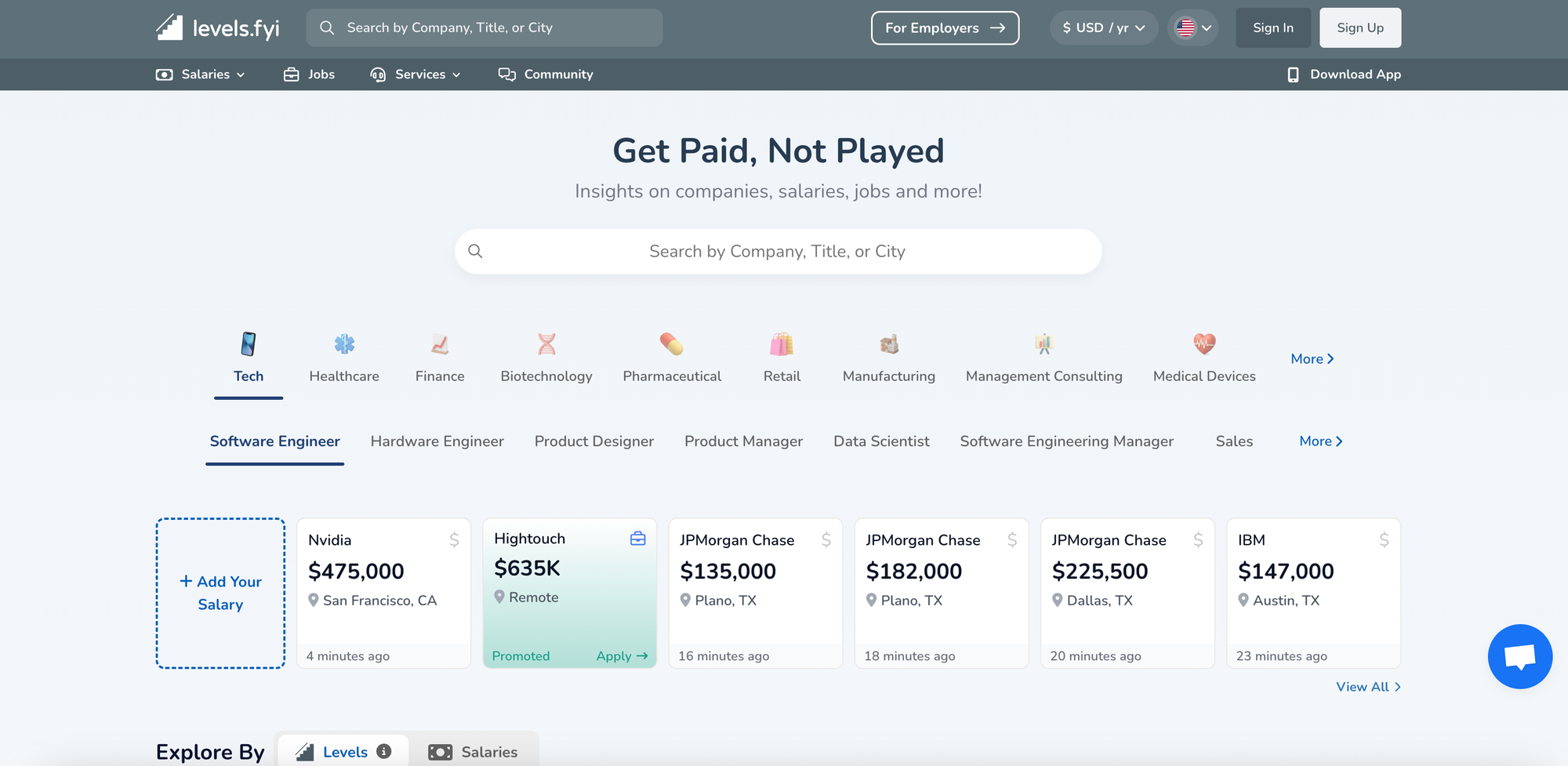

Levels.fyi

If you work in tech, this is non-negotiable.

Levels.fyi remains the most precise source for total compensation breakdowns, especially for software, data, and product roles. Base salary, bonus, equity, vesting schedules, and even negotiation outcomes are tracked with a level of detail that no general platform matches.

What makes Levels.fyi especially useful in 2026 is its company leveling clarity. Titles vary wildly across companies. Levels.fyi lets you compare role scope, not just job names, which is critical when negotiating offers.

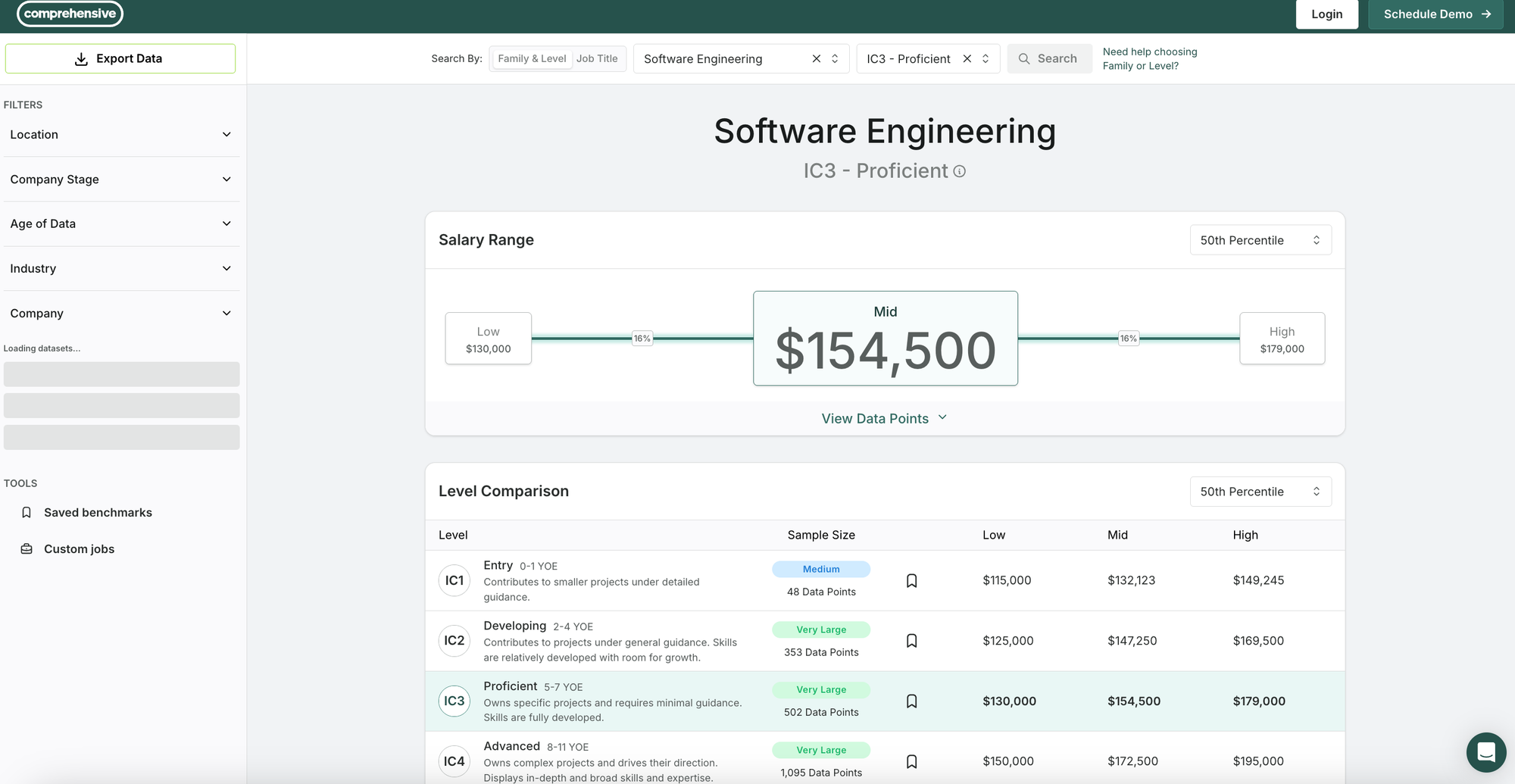

Comprehensive

Comprehensive is one of the newer compensation benchmarking platforms that more candidates should understand, even if they never touch it directly.

Comprehensive is built for employers, not job seekers. It pulls from live market data to help companies set salary bands across roles, levels, and locations, and it is designed to reflect how compensation decisions are actually made inside modern organizations.

What makes Comprehensive notable in 2026 is its focus on structure. Rather than showing raw averages, it emphasizes pay ranges, leveling consistency, and internal fairness. This is the kind of system compensation teams use to decide where an offer lands before a recruiter ever speaks to a candidate.

For job seekers, the value is indirect but important. When a company uses tools like Comprehensive, negotiation is less about pushing for an arbitrary number and more about demonstrating why your scope, experience, or impact justifies placement at the top of the band.

PayScale

PayScale shines where many others fall short: personalization.

Unlike platforms that show raw averages, PayScale adjusts salary estimates based on years of experience, education, certifications, location, and role complexity. For mid-career professionals, this often produces more realistic numbers than crowd-sourced platforms.

Its downside is transparency. You rarely see the raw data behind the estimate, which makes it harder to sanity check. Still, for professionals trying to understand where they sit in the market rather than chase the top percentile, PayScale remains highly relevant.

Glassdoor

Glassdoor is still the default starting point for most job seekers, and for good reason. Its strength is volume. No other platform combines salary data with company reviews, interview experiences, and benefit insights at this scale.

In 2026, Glassdoor’s biggest value is not the exact salary number. It is the context. You can see how pay aligns with employee sentiment, how compensation changes over time, and whether low pay is being offset by stability, brand value, or perks.

The limitation is accuracy at the edges. Niche roles, senior positions, and newer job titles often lag behind reality.

Pave

Pave is one of the strongest employer-side compensation platforms in 2026. It aggregates real, current pay data directly from companies, not self-reported employee entries. That alone makes its data cleaner than most public salary tools.

Where Pave really excels is real-time benchmarking. Companies use it to continuously adjust salary bands based on market movement, role scarcity, and location shifts. This is especially common in venture-backed tech, where pay structures change fast and hiring mistakes are expensive.

Most candidates will never see Pave directly. Its dashboards, insights, and adjustments live entirely inside compensation teams, finance, and leadership. That means Pave shapes offers before they ever reach candidates, but it does not help candidates prepare, negotiate, or understand how to win the role.

Two Underrated Salary Tools Worth Using

Blind

Blind is not a salary tool in the traditional sense, but it may be the most honest.

Compensation discussions on Blind are raw, current, and often brutally transparent. People share offer letters, negotiation tactics, and internal pay structures in a way that no polished platform allows.

You need to filter out exaggeration and selection bias. But if you want to understand what top performers are actually earning right now, Blind provides insight you will not find anywhere else.

Carta

Carta is overlooked by most job seekers, yet it is invaluable if equity is part of your compensation.

In 2026, equity packages are more complex and often less generous than candidates assume. Carta’s data helps you understand realistic equity ranges, dilution risk, and how ownership translates into long-term value.

This is especially important for startup roles, where base salary tells only half the story.

Salary Data Alone Is Not Enough

Here is the mistake most job seekers make.

They gather salary numbers, pick the highest one, and anchor their expectations to it. In reality, salary benchmarking only works when combined with preparation. Knowing the market is useless if you cannot defend your value in an interview, explain your impact, or negotiate confidently.

This is where tools beyond salary databases matter.

InterviewPal help job seekers turn data into leverage. Understanding what a role pays is step one. Being able to articulate why you deserve the top end of that range is what actually moves offers.

Interview preparation, resume feedback, and role-specific question practice are what convert market knowledge into real outcomes. In 2026’s competitive hiring environment, the strongest candidates are the ones who combine salary intelligence with deliberate preparation. The truth is, salary tools tell you what is possible while preparation tools help you get there.

2026 salary benchmarking framework

Cross-check your salary range in 6 minutes

Use this quick framework to sanity-check any salary number using multiple sources. This reduces the risk of anchoring on outdated self-reports, broad averages, or job titles that do not match scope.

Step 1: Pick your anchor source

Start with the tool that best matches your role type, then write down a low, mid, and high range. Do not stop at one number.

- Tech total comp: Levels.fyi

- Broad market baseline: Glassdoor, PayScale

- Fresh job-posting reality: Indeed

- Market trend signal: LinkedIn

- Employer benchmarking signal: Pave, Comprehensive

Step 2: Normalize the role

Most salary confusion comes from title mismatch. Normalize by scope and level, not job title. Ask: Is this IC, lead, manager, or head-of scope?

- Match level and scope first

- Adjust for location and remote policy

- Separate base, bonus, equity

- Account for hiring cycle pressure

Step 3: Run the cross-check matrix

If at least three sources agree within a tight band, your range is probably realistic. If they disagree wildly, your role is likely under-labeled, over-scoped, or location-adjusted.

| What you are validating | Best tool(s) | What to watch for |

|---|---|---|

| Total compensation (equity heavy) | Levels.fyi, Carta | Level mismatch, vesting assumptions |

| Base salary range (broad market) | Glassdoor, PayScale | Old entries, title inflation |

| Current job-posting range | Indeed | Wide ranges used for attraction |

| Trend direction by region | Conservative estimates, lag by industry | |

| How employers set bands | Pave, Comprehensive | Band discipline, less flexibility |

| Reality check from peers | Blind | Selection bias, outlier posts |

Pro tip: Save your final range as a sentence you can defend, not just a number. Example: “Based on level and scope, I am targeting $X to $Y total comp, with flexibility depending on equity and role breadth.”

Mini glossary for salary benchmarking keywords

Leveling: The internal seniority framework (for example L3 vs L4) that often matters more than your job title.

Band: The approved pay range for a role and level. Negotiation usually happens inside this range.

Total comp: Base salary plus bonus plus equity (or commission where relevant).

Location adjustment: Changes to pay based on where you live or where the role is anchored.

Negotiation checklist before you counter

- Confirm the level and scope, then counter the range, not the number.

- Separate base from equity and bonus, and decide what you value most.

- Bring proof: portfolio impact, metrics, competing process, or scarcity skills.

- Practice your delivery. A good counter is calm, specific, and justified.

Salary benchmarks set the frame. Negotiation decides where you land inside it.